Consumers arriving at Chevrolet dealerships around the country looking to lease their next vehicle are realizing that signing on the dotted line also means paying a higher interest rate. According to economic reports, the Federal Reserve raised the benchmark interest rate from 2.25 percent to 2.50 percent. The interest hike equates to 25 basis points in economic terminology. Of course, the first thought is, per economic trends and consumers’ spending habits, consumers will be thinking twice about that shiny new first, second, or even third vehicle. However, it’s important that they do not jump to a gloomy conclusion regarding how this interest rate increase will impact their ability to enter into a new lease. Yes, as with any type of credit, leasing terms are affected by higher interest rates. The good news is, though, the impact on lease agreements is not as harsh as it is on car loans. Leasing agreements are impacted less than car loans because when consumers lease vehicles, they are only paying interest on the vehicle’s depreciation. To complement this positive news, there are steps consumers can take to help them get a good Chevy lease deal.

Do Your Homework

Consumers should not assume that they do not qualify for or cannot afford a Chevy lease simply because there has been an increase in interest rates. First thing’s first, it is important to crunch the numbers. There is conclusive information regarding the relationship between higher interest rates and leasing agreements, but it’s important for consumers to see actual figures regarding costs. Consumers can accomplish this step by contacting a specific Chevy dealership or browsing several dealerships. Consumers can visit dealerships, contact them by phone or visit their websites to get information on the latest lease deals and relevant consumer costs. However, it is also important for consumers to keep in mind that the marketing information they receive from dealerships is based on a certain set of variables that may or may not reflect their specific situation. Most leasing advertisements will include a disclaimer in the fine print detailing the variables used to calculate the promotions and incentives described in an ad. Once consumers decide to begin their search for a new vehicle, there is another way to get a projection of leasing costs that are more relevant to their situation.

Get Prequalified for a Lease

As previously noted, consumers can contact dealerships they’re interested in doing business with to get general lease-term information prior to beginning their physical search. To get the most definitive information, however, consumers should get prequalified for a lease. Just like with traditional car loans, consumers can determine what financial terms they are eligible for prior to contacting a dealership to discuss leasing options. When it comes to leasing agreements, as is the case with car loans, consumers’ credit score and financial ability to make monthly payments are the primary factors when determining their costs during the leasing period.

Negotiate Leasing Terms

To get the best Chevy lease deal with the least possibility of incurring additional costs during their leasing period, consumers should arrive at their dealership of choice ready to negotiate. Negotiating the best terms is an important step. If higher interest rates were to increase costs to a point that falls outside a consumer’s budget, negotiating potentially provides a way for a consumer to compensate for those additional costs. It’s important for consumers to understand leasing terminology. Here are a few key terms consumers will surely come across, along with an explanation regarding their relevance to the negotiating process:

A Closed-End Lease means the consumer does not owe any additional costs if the vehicle’s actual value is less than its residual value, which is calculated when the lease agreement is originated. Consumers should always inquire about this type of lease if they’re looking for the least expensive option.

Mileage Allowance is the number of miles included in the lease agreement. If consumers exceed this mileage limitation, they are charged an Excessive Mileage Fee. If the vehicle is the sole source of transportation and/or the vehicle is needed for an above-average amount of driving, it’s important to understand this leasing-agreement component and estimated costs when exceeding the mileage limit. Additionally, the mileage allowance can be negotiated.

The Excessive Wear-and-Tear Fee, as the name implies, is assessed if it’s determined the vehicle’s wear-and-tear exceeds what is deemed normal for the term of the lease. Consumers should take note of the vehicle’s condition, carefully examining the interior and exterior. If there are any imperfections, consumers should note them, preferably in writing and with a photo. Once the car’s overall condition is assessed, this information should be provided to the salesperson responsible for closing the lease agreement. Consumers should request the assessment information is added to the lease agreement.

Early-Termination Fee refers to the fee consumers pay if they prematurely end their lease agreement. In some instances, this fee can be equivalent to the collective cost of the remaining lease payments. It’s important for consumers to know to ensure the monthly payment is within their budget, and if an unfortunate event takes place that requires them to terminate the lease agreement prior to the end date, they are able to afford that designated cost.

This is only a partial list of leasing terms. For more information regarding terms, consumers should and need to be familiar with to effectively negotiate their leasing agreements, visit the Consumer Reports website.

Downsize the Vehicle

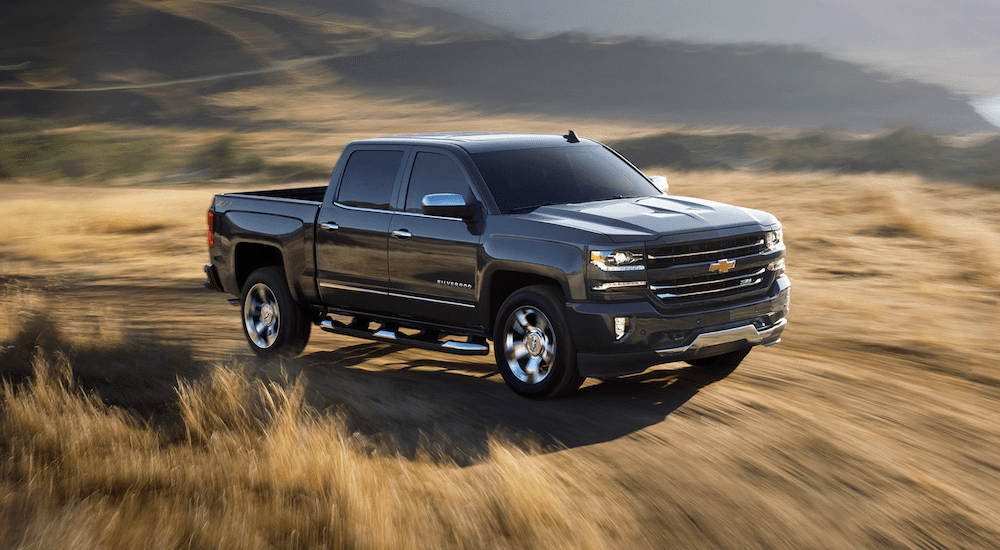

When most consumers begin their car search, they have a specific vehicle in mind. However, rising interest rates may have them rethinking their original selection due to the potential for increased costs. The bigger the vehicle, the bigger the price tag (and the more consumers will pay in interest). The beauty of opting for a Chevy vehicle is the automobile manufacturer provides consumers with a variety of options, giving them the ability to downsize by selecting a different vehicle. Previously, that may have meant settling for a vehicle that didn’t come close in comparison to a consumer’s original vehicle of choice as it relates to features and options. Today that is not the case. Chevy gives consumers access to a variety of vehicles, ranging from compact models to SUVs, with leasing options to fit almost any budget.

Delay the Sale

If consumers are still contemplating entering into a new lease agreement, delaying the decision to begin a new lease may be the best option. Interest rates constantly fluctuate depending on numerous economic factors.

By delaying the leasing process, consumers are able to allow interest rates to drop to a point they are comfortable with. At that point, they are able to proceed with their original plan of starting a new lease agreement.

Conclusion

The mere thought of higher interest rates may cause many consumers to think twice before making the decision to enter into that new lease agreement they had been considering, but it does not have to be a situation that has consumers second-guessing fulfilling a goal. Lenders realize consumers are hesitant to purchase, which creates a favorable situation for consumers. Lenders are more willing to negotiate and to offer flexible lending options. Chevy recognizes this scenario and works with its customers to help them find the best lease deal that fits within their budget. If you’re in the market for that next vehicle, stop in and talk with sales staff at one of your area Chevy dealerships.