While Fiat-Chrysler, as a whole, remains one of the most diverse and innovatively successful automakers out there, their flagship brand has been enduring a noticeable identity crisis in recent years. Seriously, think about it. When was the last time you were truly captivated by a Chrysler-brand offering? When was the last time any one of them found their ‘vanilla selves’ at the center of current auto news?

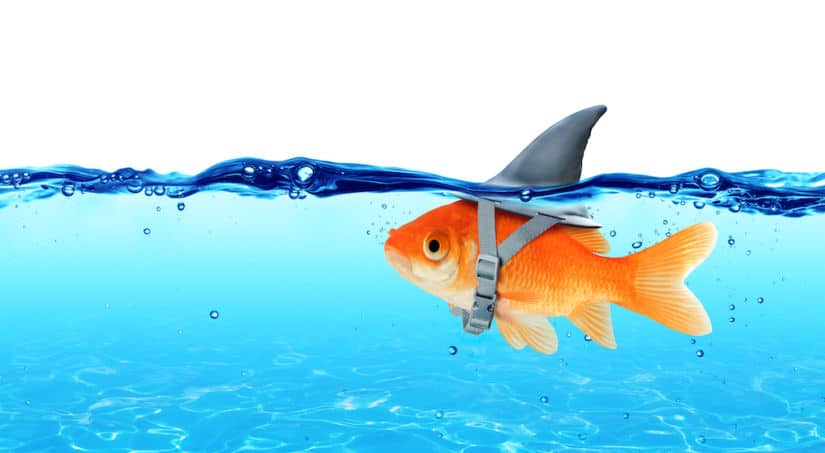

Amidst the resurgence of Dodge muscle, the powered-up and redesigned Jeep offerings, the ever-iconic RAM styling, and understandable excitement surrounding the likes of Maserati and the resuscitated Alfa Romeo lineups, Chrysler feels as though its fallen by the wayside at FCA. While distinctive, Chrysler styling feels like a square peg in a round hole. And in terms of price points, well…from the high-20’s into the 40’s, prospective buyers might set their sights a little bit higher than an undervalued domestic mainstay. And for that reason, Chrysler models tend to blur easily into the background, moving just enough units to stay somewhat relevant.

Take the Chrysler 300 sedan, for example. While it may not be everyone’s ‘cup of tea’, it has endured nearly 15 years and two generations, catering to a specific niche of domestic ‘luxury’ enthusiasts. And among the minivan crowd, the Chrysler Pacifica remains a stalwart fixture having earned J.D. Power and Associates’ pick for “Highest Ranked Minivan in Initial Quality’ and cars.com’s ‘Car of the Year’, among various other ‘Best Buy’ awards. But then what? Nothing.

Just a Piece of Marchionne’s Puzzle

Perhaps it’s no surprise that leading up to mid-June, there was heavy speculation that the Chrysler brand was on its last legs. With Fiat-Chrysler having announced a mid-month address from CEO Sergio Marchionne, a number of news venues cited the reasonable prediction that they would be retiring the brand. And while none of us would have been surprised had that plan been the core of the announcement, the actual heart of what Marchionne laid out was a surprise for just about everyone.

How well do you remember 2014? Even if you don’t remember the specific details, it stands to reason that it ‘feels like yesterday’ and flew by in the proverbial blink of an eye. Well, the over-arching theme of Sergio Marchionne’s statement was his aggressive plan to make FCA the most profitable Detroit-centric automaker in the United States by 2022. Considering that such a declaration starts the countdown on a four-year timer, the brand has their work cut out for them.

But Marchionne’s tenure as FCA’s top dog proves that he might be the only person capable of making such a declaration laudable. Consider the ease which Fiat gained control over Chrysler, following their Chapter 11 filing a decade back. Acquisition of the iconic Jeep brand was an immediate win, offering both profitability and an enthusiastic customer base hungry for more products. RAM trucks provided reputability and a valuable seat in the ever-evolving truck segment, and Dodge’s reinvention of their own muscle car pedigree was creating unparalleled buzz. Combining these two of Europe’s most exclusive offerings in the form of Maserati and Alf Romeo, and FCA had four brilliant cornerstones upon which to build. Marchionne was instrumental of uniting these brands into a thrilling, and singular, entity. And now, with his scheduled retirement looming, slated for April of 2019, it was his responsibility for initiating whatever momentum would be gained through an outgoing five-year plan. And while the Chrysler-brand may not be a major component of that plan, the good news is that it doesn’t really need to be.

The Plan?

An automaker would have to be foolish to opt out of the race for autonomous driving. Fortunately for FCA, Marchionne is no fool, and the deepening of the company’s relationship with Waymo (operated by Google’s parent company) is a wise strategy. Fueled by his own testimony that the future is driving will more likely be shaped by a blend of Silicon Valley tech and government regulation than by actual automakers, Marchionne has humbly accepted a contributing role in the hopes of a leading payoff.

And as a contributor, finance certainly comes into play. The evolving demands of software development and integration, along with the demand for more sustainable energy sources, will require some deep pockets. And with that in mind, it seems ironic that FCA’s revenue stream will be heavily depending on the three offerings most diametrically-opposed to the industry’s long terms goals. Why? Because Jeep, Dodge and RAM offer some of the fattest (and simplest to increase) profit margins of any FCA property. The idea that FCA’s strives towards sustainable autonomy will be fueled by three gas-guzzling lineups that embody the ‘love of driving’ is humorous, to say the least.

Consider, for a moment, the Dodge Challenger SRT Demon. Or the Jeep Grand Cherokee Trackhawk. With price-tags that dance around the $100K mark, FCA is reasserting itself among the enthusiast fan-base that might feel betrayed by the evolution towards modest fuel-economy. As one of them, I can tell you, that horsepower enthusiasts are eating these products up (since we don’t know how long this renaissance will last).

And milking the cash-cow is a prudent move. Automakers need to recognize that they will not be the (excuse the pun) driving force behind this transition. Industry-wide decisions are being made at the governmental level, driving innovation. And with private sector tech companies proving to be more solution-driven, automotive shareholders are growing progressively more accustomed to seeing new tactics employed to grow, and redirect capital. Ten or twenty years ago, such tactics might be labeled rushed, or hasty. But now, progress is moving at an exponential rate, and automotive C-levels know what needs to be done.

While we still don’t know what will come of Chrysler-brand items in the long run, they serve as a perfect example of cull-able inventory. Automakers continue to recognize that full lineups of cars, trucks, crossovers and SUVs is no longer required or expected. Consumers prefer to see an automaker do what they do best, and stick with it. At least until the next wave takes our commute in new, and more innovative directions.